Compound interest is one of the most powerful forces in finance. Whether you’re saving for retirement or growing an investment portfolio, understanding how compounding works is essential for maximizing your financial success. In this blog, we’ll dive deep into the concept of compounding and explore how it can work for you over time.

Compound interest, or compounding, refers to the process where interest earned on an investment is reinvested, so that in subsequent periods, you earn interest on both your initial investment (the principal) and the accumulated interest. This effect is often referred to as “earning interest on interest,” and it accelerates the growth of your investment as time progresses.

In simple terms, the longer your money is invested, the more it compounds, resulting in exponential growth.

The power of compounding lies in its ability to accelerate growth over time. For example, if you invest $1,000 in a savings account with an annual interest rate of 5%, you’ll earn $50 in the first year. In the second year, you’ll earn interest on the initial $1,000 as well as the $50 you earned in the first year, meaning your interest grows faster each year.

This effect becomes more pronounced over time. If you leave your investment untouched for 20, 30, or even 40 years, compounding will continue to work in your favor, turning a small initial investment into a significant sum. The key is to start early and allow your investments to grow.

The biggest benefit of compound interest is that you make a lot more money than with simple interest. In fact, there’s something called the Law of 72 that says that the number 72 divided by the annual interest rate is the number of years it will take to double your money without ever contributing another cent. Based on the example above, it would take you approximately 14 years to double your money.

The earlier you start saving in a compound interest account, the greater the advantage you get. As the numbers get bigger, so does the benefit of compounding. Think of it like a snowflake turning into a giant snowball—the longer the hill is, the bigger the snowball can get. The other factor is how often the interest is compounded, or added to your balance. The more often the money is compounded (Cooper Pacific offers monthly or quarterly compounded options), the faster it grows.

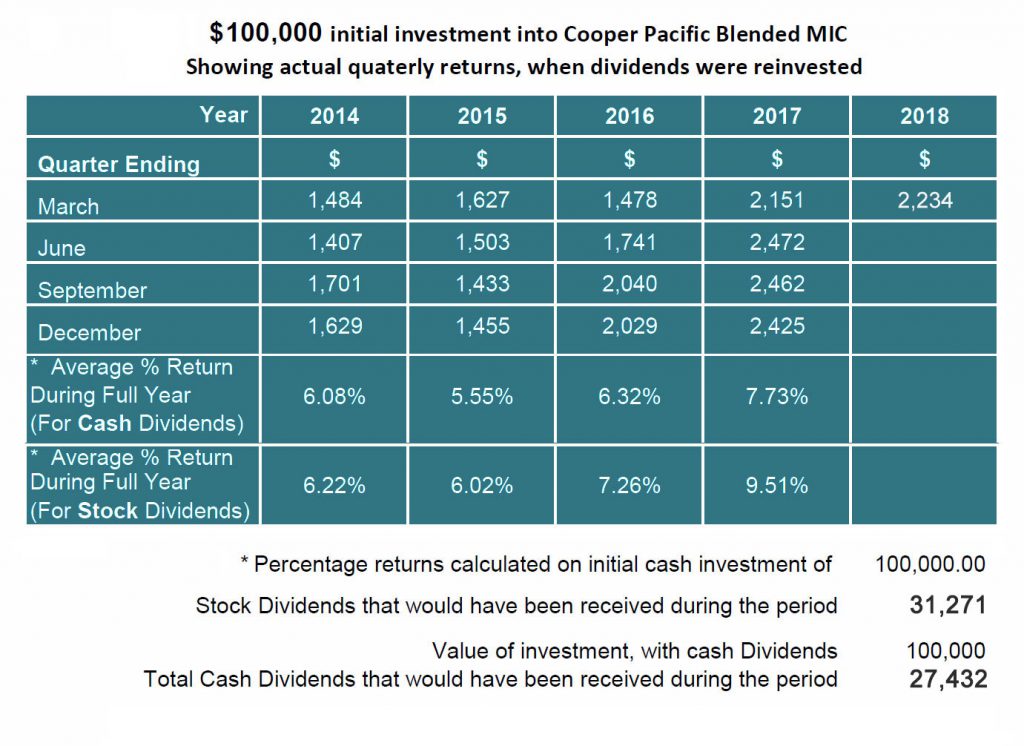

Let’s take a look at a possible scenario as an example to illustrate the power of compounding.

Suppose you invest $10,000 in an investment that earns an average return of 6% per year. After one year, your investment will have grown by $600, bringing your total to $10,600. In the second year, you earn interest on the new balance ($10,600), not just the initial $10,000. By year five, your investment grows to $13,382. Over 10 years, it would be worth $18,114.

This is the power of compounding at work. With time, your returns will generate their own returns, leading to substantial growth with minimal effort.

The secret to making the most of compounding is patience. It’s a gradual process that builds over time, but it’s incredibly rewarding in the long run. By allowing your investments to compound, you’re setting yourself up for future financial success, whether you’re investing in stocks, bonds, or real estate investment trusts (REITs) or mortgage investment corporations (MICs).

If you’re looking for alternative investment vehicles, options like mortgage investment corporations (MIC funds) or Canadian real estate investment trusts can offer alternative opportunities for compounding returns. These alternatives can provide a potential steady income and capital appreciation, contributing to the compound growth of your portfolio.

By diversifying into real estate investment groups or mortgage pooled investments, you can harness the power of compounding in a variety of asset classes. The key is to choose investments that align with your long-term financial goals and risk tolerance, ensuring your portfolio grows steadily over time.

The power of compounding interest in investing, whether in traditional or alternative investments, is undeniable. If you want to easily accumulate wealth and take advantage of the magic of compound interest, it’s essential to start early and be consistent. As you can see in the example above, it’s possible for your money to grow to a large sum with a small initial investment. If you consistently save and invest, you’ll have a nice nest egg by the time you retire. Ready to start today? Get in touch with Jordan on our team.