Retirement planning means looking ahead, but it also requires smart strategies for using your savings when the time comes. A Tax-Free Savings Account (TFSA) is one of the most powerful tools available to Canadians for building wealth, reducing taxes, and growing investments over time. Unlike an RRSP, a TFSA allows for tax-free investment growth, making it an ideal vehicle for long-term financial planning.

A TFSA provides flexibility and tax advantages that can significantly boost your financial security. Here are some of the best ways to use a TFSA:

A TFSA allows your investments to grow tax-free, making it an excellent tool for maximizing compounding interest over time. Unlike an RRSP, where you receive a tax deduction for contributions but pay taxes upon withdrawal, a TFSA uses after-tax dollars, meaning you don’t pay tax on any investment growth or withdrawals. This makes it particularly beneficial for those expecting to be in a higher tax bracket in retirement. Whether you invest in stocks, bonds, or real estate-backed assets, the ability to reinvest earnings without tax implications can significantly accelerate your financial growth.

A TFSA is an excellent way to put money aside for your beneficiaries. It can complement a Registered Education Savings Plan (RESP) if you’re saving for your children’s education, and if they decide not to attend school, the funds remain available for other uses. A TFSA can also be a tax-efficient way to leave money to your loved ones. Unlike an RRSP, which is taxed upon withdrawal, TFSA funds can be passed on tax-free, ensuring your beneficiaries receive the full amount. Consulting a financial advisor can help set up your TFSA correctly for estate planning.

One of the greatest advantages of a TFSA is its flexibility. Unlike an RRSP, where withdrawals are taxed, and the contribution room is lost upon withdrawal, a TFSA allows you to withdraw funds tax-free and regain the contribution room in the following year. This makes it a valuable tool for long-term and short-term savings goals, such as purchasing a home, funding a major life event, or handling unexpected expenses.

For example, if you’ve contributed $6,000 annually to your TFSA for four years and withdraw $10,000 in one year, the following year, you can contribute up to $6,000 plus the $10,000 you withdrew. Unlike an RRSP, which doesn’t allow re-contributions of withdrawn amounts, a TFSA offers this flexibility.

A TFSA can be a crucial asset for those looking to retire early. Most government or workplace pensions only become available after a certain age, and early withdrawals from an RRSP are subject to taxes and penalties. With a TFSA, you can build a tax-free income stream that supports early retirement without affecting your taxable income. Many investors leverage their TFSAs to invest in high-growth assets such as real estate investment groups or mortgage investment corporation (MIC) funds, allowing their savings to grow while remaining accessible for retirement needs.

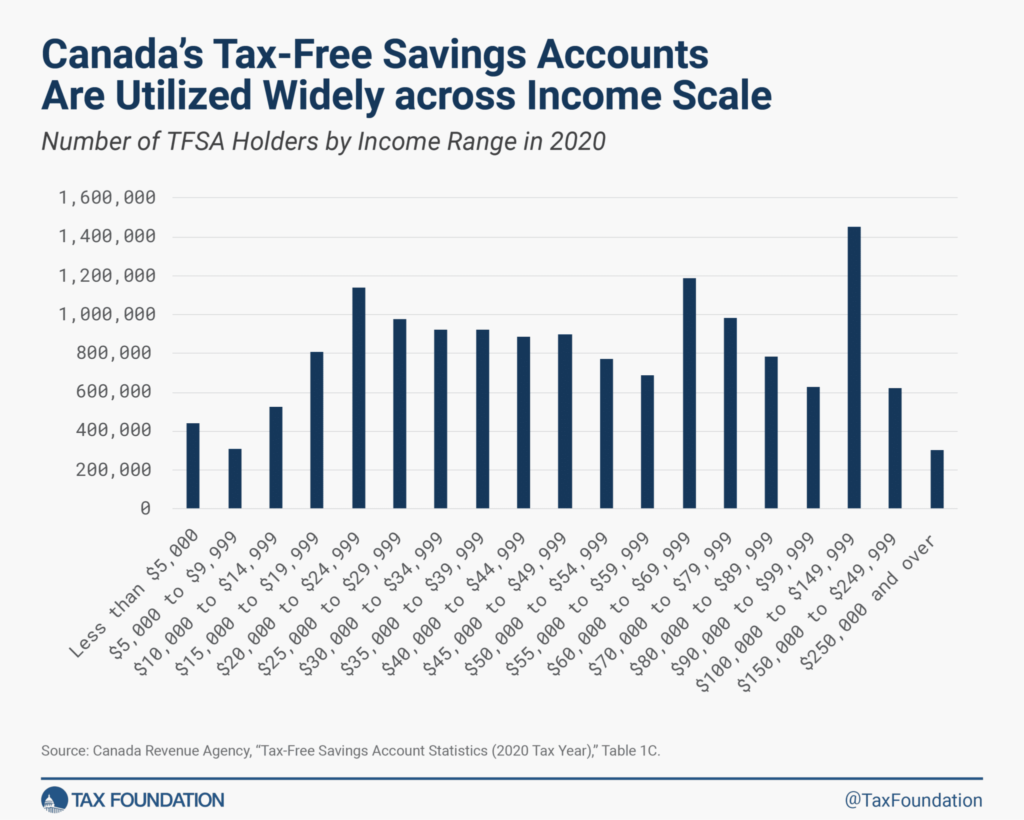

The benefits of TFSAs are why so many Canadians across various income brackets are utilizing this account type, as shown by this graph from the Tax Foundation.

Thanks to compounding interest, the sooner you start using your TFSA, the more benefits you’ll reap. Whether you’re investing in traditional stocks, mortgage investment corporations, or real estate investment groups, a TFSA offers unparalleled tax advantages and flexibility. By incorporating TFSAs and RRSPs into your financial plan, you can maximize tax efficiency, grow your wealth, and create a well-rounded strategy for the future.

If you’re interested in learning how to use mortgage investment corporations or some of the best real estate investment opportunities available to Canadian investors, contact Jordan on our team today. Cooper Pacific specializes in alternative investments and mortgage pools that can help you maximize your financial growth while maintaining stability and security in your portfolio.