At the beginning of the COVID-19 pandemic, rates were reduced to protect the economy, stimulate spending, and make it easier for individuals and businesses to borrow money. As things begin to rebound, interest rates also start to rise to level off the impacts of inflation. As rates rise, many brace themselves for the effects on numerous markets. One market that rising rates could impact is stocks – specifically growth stocks.

A growth stock is a stock that has the potential to offer substantially higher growth rates to investors because the company is focused on rapid growth. They rarely provide dividends for this reason, as the revenue is often reinvested to sustain rapid growth. There is a risk associated with some of these stocks because there are little to no dividends. In this way, the investor relies on the company’s success rather than annual dividends.

A few examples of growth stocks are Amazon, Facebook, and Netflix.

These giants are not exempt from the impacts of rising rates as the USA and Canada try to curb the effects of high inflation.

Rising rates and stock prices are believed to work on a pendulum, and when one increases, the other falls. This seesaw-like nature happens because stock prices are based on the future earning potential of a company. As rates rise, the future earning potential declines, and thus the stock loses value. For example, $300 at a 1% rate is $30,000, but if that rate increases to 2%, then the earnings are half that amount.

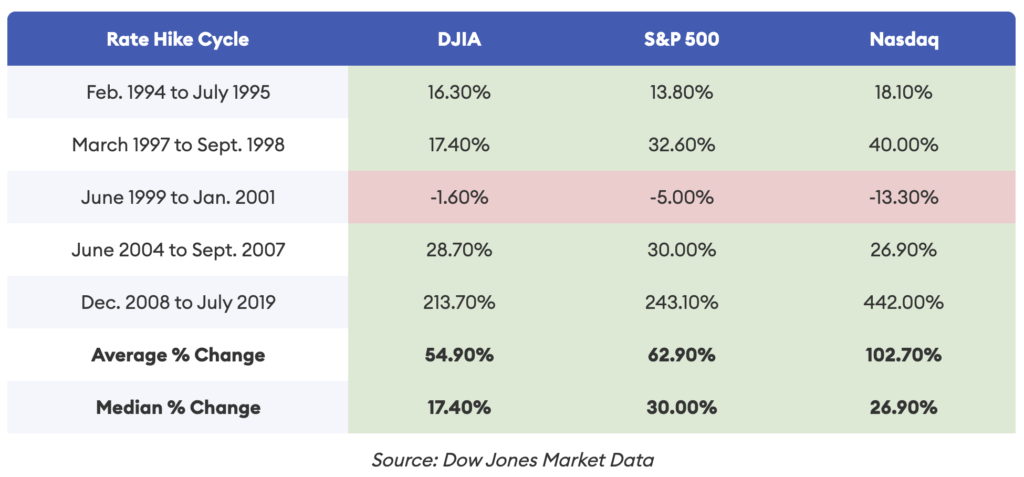

This opposing nature may not be what happens in reality when rates rise. Growth stocks appear to have performed well over time despite rate increases. Some industries may not be impacted in the same way during rate increases. A financial sector stock will have a different experience during rate increases compared to tech or travel. Another factor is how aware investors are of the psychology of investing. If investors understand how fear can influence a market, they can plan accordingly and weather the slight dip that happens when a rate increase is first announced.

Although rising rates will impact the economy and interest rates on loans and mortgages, the overall impact on investments could be relatively minor. There will likely be an immediate impact as investors sell shares and homes sit on the market for longer. However, this will likely rebound and level out quickly. For example, the US Fed announced a rate hike in 2017, and the S&P 500 dropped .5% in a day. However, this decline was quickly forgotten as it gained 4.6% over the next month.

Diversifying and considering the long-term impacts of a rate increase is key to any successful investment strategy. Yes, rising rates will cause stocks, bonds, and loans to perform worse as many investors sell and loans become more expensive. However, if you can continue to stick with your strategy, buying stocks at this lower rate could pay off when things begin to rebound in the future.

One thing is for sure, during market fluctuations, investors tend to look for more stable companies and investments. Instead of looking at tech startups, an investor would look at buying shares in older stable companies or alternative assets that are more stable, such as real estate.

The rate increase will impact the housing market as sales slow down and things cool off. However, many experts do not believe we will see a significant drop in real estate prices. Development is not slowing down as more and more people move to British Columbia, and more housing is needed. Now could be the perfect time to invest in a mortgage pool as interest rate increases mean higher returns for investors. Curious about how rising rates will impact mortgage pools and how you can take advantage? Get in touch with Jordan on our team.