Registered accounts, such as RRSPs and TFSAs, are powerful tools for building long-term wealth and minimizing your tax burden. But what happens when you don’t fully take advantage of them and maximize your RRSP and TFSA contributions? The hidden costs of underutilization can quietly erode your financial future, from lost investment growth to missed tax savings.

Let’s explore what’s really at stake when you leave contribution room on the table—and how proper planning can turn these missed opportunities into financial wins.

One of the key advantages of both RRSPs and TFSAs is the ability to grow your investments either tax-deferred or tax-free. When you under-contribute, you miss out on years—sometimes decades—of compounding returns in a tax-sheltered environment.

Let’s say you delay contributing $6,000 to your TFSA for three years. If that amount had grown at a 6% annual return, you’d miss out on nearly $1,200 in tax-free growth. Over a 20-year span, that opportunity cost balloons.

RRSP contributions reduce your taxable income for the year, and TFSA withdrawals are not taxed at all. By not maximizing your contributions, you could end up paying more income tax than necessary, both now and in retirement.

A 45-year-old in a high-income bracket who doesn’t contribute to their RRSP could be missing out on $3,000–$5,000 in annual tax savings. That’s money that could have been reinvested to generate even more long-term value.

While TFSA contribution room accumulates if unused, not using it means you’re still missing years of potential growth. RRSP room is technically carried forward, but without proper planning, people often leave it unused for too long, especially in lower-income years when contributions could still provide long-term benefits.

The earlier you invest, the greater your potential return. Underutilizing your registered accounts delays your entry into the market, and when it comes to investing, time is your biggest ally.

An investor who contributes $5,000 to their RRSP at age 30 and earns an average 7% return annually will have nearly $38,000 by age 60. Waiting until 40 to contribute that same amount yields just under $19,000—half as much.

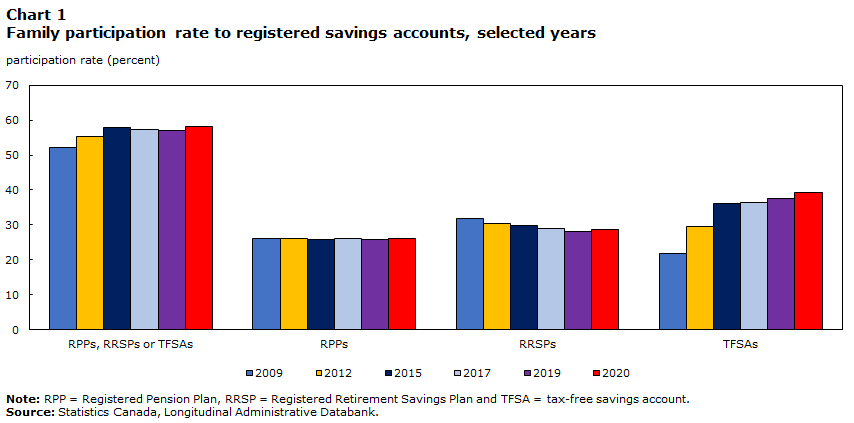

Withdrawing from your RRSP early comes with tax consequences and may impact your long-term retirement savings. In contrast, strategic TFSA withdrawals allow for more flexibility, especially when combined with non-traditional investments, such as mortgage investment corporations (MICs) or real estate investment pools, which can offer steady returns and more accessibility than other alternative investment types. This is one of many reasons contributing to the increased popularity of TFSA accounts over RRSP accounts.

Consider two investors:

Assuming a 6% average annual return, Alex will have nearly $200,000 more by age 65 than Jordan—all because they started earlier. Since TFSA gains are tax-free, that difference is even more significant in retirement.

At Cooper Pacific, we help investors align their registered account contributions with long-term investment opportunities. Whether you’re looking to diversify with MIC funds, gain exposure to real estate investment banking, or explore the best real estate investment in Canada, your RRSPs and TFSAs can be powerful vehicles to help you get there.

Every dollar left out of your RRSP or TFSA is a missed opportunity to reduce your taxes, build wealth, and prepare for a more secure future. With the right approach, registered accounts can do far more than just store savings—they can become the cornerstone of your investment strategy.

Want to explore how to integrate mortgage investments or real estate-backed assets into your registered accounts? Contact Jordan on our team today to learn how you can put money in a TFSA to work in ways you might not have considered.