It can be unnerving when there are changes in political parties, both at home and in neighboring countries. As policies and power shift, you may wonder what the impact will be on your investments, be it traditional investing or more alternative investment vehicles. With a change in the U.S. presidency and a Canadian federal election, and general uncertainty on the horizon, investors are watching closely to understand how these changes may impact their portfolios.

While short-term volatility can be an outcome, history has shown that markets adapt over time, and real estate investments—particularly mortgage investment corporations (MICs)—can offer stability amid uncertainty.

Markets react to uncertainty, and elections create plenty of it. Historically, stock markets experienced increased volatility in the months leading up to a major election. However, long-term market performance is driven more by economic fundamentals than political leadership.

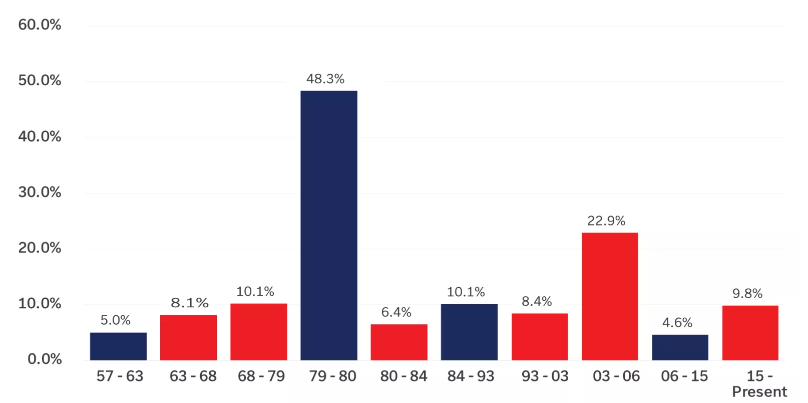

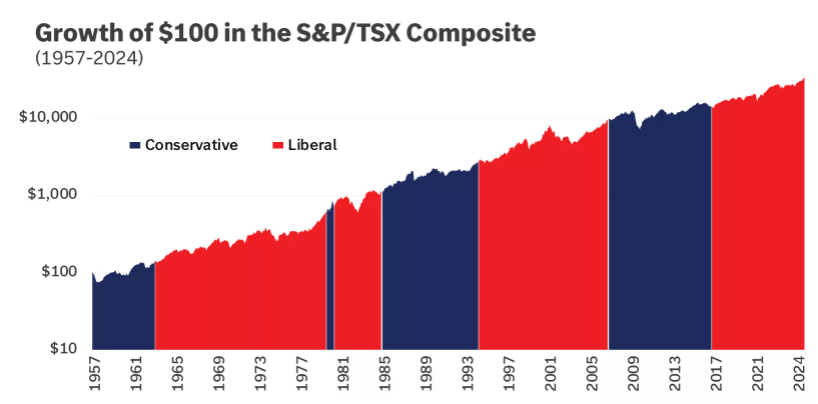

For instance, data from past U.S. elections show that while short-term fluctuations occur, the S&P 500 has generally trended upward over time, regardless of which party holds power. Similarly, in Canada, changes in government can lead to shifts in fiscal policy, taxation, and infrastructure spending—each with varying effects on different industries. However, strong economic growth and resilient sectors tend to prevail despite political shifts.

Leading up to an election, investors often adopt a more cautious approach. Increased volatility, sector rotation, and fluctuating interest rates can all contribute to market uncertainty. Some trends that have historically emerged during election years include:

While short-term uncertainty can be unsettling, long-term investment strategies are best built on economic fundamentals rather than political cycles. Over decades, markets tend to adjust to new policies, whether they involve taxation, infrastructure spending, or regulatory changes.

Investors focused on diversification and fundamental asset growth often see more substantial returns over time. In the long term, traditional and alternative investments, such as real estate-backed mortgage investments, provide stability amid shifting political landscapes.

Canada and the U.S. share deep economic ties, meaning political changes south of the border can have a ripple effect on Canadian investments. Trade agreements, corporate tax policies, tariffs, and cross-border economic strategies can all impact investor confidence.

Amid political uncertainty, real estate generally remains a stronghold for investors seeking stability. Unlike stocks, which react quickly to election outcomes, real estate investments—particularly mortgage investments—tend to offer more predictable returns.

Mortgage investment corporations (MICs) allow investors to access real estate-backed lending opportunities. Since these investments are tied to tangible assets rather than market speculation, they are less susceptible to short-term political fluctuations. Historically, real estate has remained resilient through varying economic and political cycles, making it an attractive option for investors looking to balance risk and reward.

Political events will always introduce a level of uncertainty into financial markets, but long-term investment strategies should be built on resilience rather than reactionary decisions. While stock markets and alternatives such as crypto may experience volatility during election years, alternative investments with more stability, such as real estate and MICs, can provide steady returns regardless of political changes.

At Cooper Pacific, we help investors navigate economic cycles with secure, asset-backed mortgage investments. If you’re looking for a stable and predictable investment strategy, contact Jordan on our team to learn more about how MICs can support your financial goals.